What Are Multi-Asset Allocation Funds and How Do They Work?

Deciding where to invest your money can be a challenging process, given the numerous investment options. That's where multi-asset allocation funds can come in. These funds offer a way to invest in a variety of assets through a single avenue, thereby simplifying the process for investors.

Let’s take a closer look at what multi-asset allocation funds are and why they can be a suitable option for investors.

- Table of contents

- Understanding multi-asset allocation funds

- How asset allocation works in multi-asset funds

- Advantages of investing in multi-asset allocation funds

- Who should invest in multi-asset allocation mutual funds?

- Key features of multi-asset allocation funds for long term growth

- Key factors to keep in mind before investing

- Multi asset allocation fund investment strategies

- Multi asset allocation fund investment tips

- How to choose the right multi-asset allocation fund

Understanding multi-asset allocation funds

A multi-asset allocation fund is a type of hybrid mutual fund that spreads your money across stocks, bonds and at least one more asset class. This could include commodities, real estate investment trusts, derivatives, foreign assets, etc. This diversification can help in mitigating risks and taking advantage of different market conditions. The idea is to provide investors with a balanced portfolio through a single investment.

By including various asset types that respond differently to economic trends, these funds aim to optimise the balance between risk and reward. The diversification also allows investors to gain exposure to markets and opportunities they might not have considered individually.

Moreover, they can gain this exposure and its potential benefit without having to deeply understand each market or asset class. Fund managers take care of portfolio selection and monitoring. They can also dynamically readjust the portfolio in response to market movements.

How asset allocation works in multi-asset funds

In a multi-asset allocation fund, the fund manager decides how to allocate the fund’s capital across different asset classes. The allocation is based on detailed market analysis and the fund's defined investment goals.

For example, during times of stock market volatility, the manager might increase the fund’s holdings in bonds, which are typically more stable than equities. This flexibility is central to the working strategy of multi-asset allocation funds. Asset allocations are not static; they can adjust in response to economic indicators, market forecasts, and regulatory changes.

This dynamic approach helps in optimising returns while mitigating risk by allowing the portfolio to adapt to different economic cycles and market conditions.

Advantages of investing in multi-asset allocation funds

- Built-in diversification: These funds automatically spread investments across multiple asset classes, reducing the risk of significant losses if one class underperforms.

- Professional management: Experienced fund managers design these portfolios, adjusting allocations based on detailed market conditions and forecasts, which enhances the potential for better returns.

- Adaptability to market changes: The dynamic nature of these funds allows them to adapt quickly to economic shifts, potentially reducing the impact of market volatility on the investment.

- Access to a wider range of assets: Investors gain exposure to a broader range of assets, including international markets and alternative investment options, which might be difficult to access individually.

- Simplicity: Multi-asset allocation funds provide a straightforward and simple way for investors to own a diversified portfolio without the need to manage multiple transactions and research individual assets.

These advantages make multi-asset allocation funds an attractive option for investors looking for a balanced approach to investment with the convenience of professional management.

Who should invest in multi-asset allocation mutual funds?

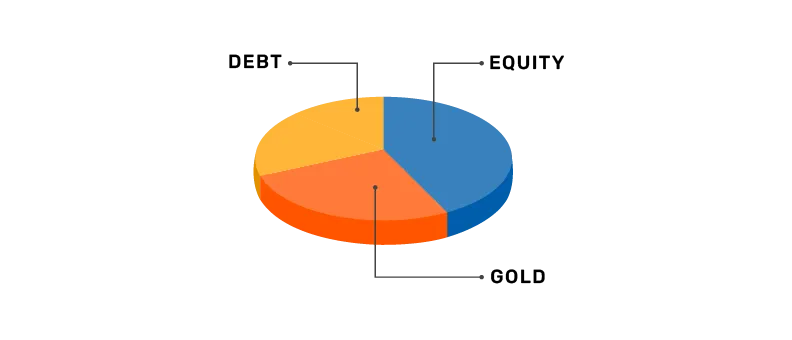

A multi asset allocation fund invests in at least three asset classes, with a minimum allocation of 10% in each. These usually include debt and equity and commodities such as gold and silver.

The fund has a typical distribution range among these assets, within which fund managers can rebalance the portfolio in response to market conditions and their analysis. This multi asset allocation fund guide for long term investors tells you more about what could make these funds a good fit for extended investment horizons.

Key features of multi-asset allocation funds for long term growth

- Portfolio diversification: Portfolio diversification is considered an important risk-mitigating tactic for financial market investments because it avoids dependency on one or a limited group of assets. Many mutual funds allow allocation of assets across equity and debt, but multi asset allocation funds include at least one more asset class, resulting in greater diversification.

- Asset class correlation: By investing in multiple asset classes, the fund can reap the benefits of whichever one is performing well at a given point of time. In the long run, this can help investors benefit from multiple market cycles. This is because different asset classes don’t usually move in tandem – one may go up while the other goes down. For instance, debt and stocks tend to move in opposite directions. During a slowdown, debt may perform better as investors seek stability, while equity may have higher return potential when the markets are good. And at times when both debt and equity are underperforming – such as during the Covid-19 Recession – an asset class such as gold could be more reliable.

- Flexibility in asset allocation: The minimum investment threshold for a multi asset allocation fund is 10% per asset class, which means a skilled fund manager has significant room to make strategic allocations depending on what is performing well in the market. The mutual fund portfolios can thereby leverage market fluctuations without investors having to independently time the market.

- Accommodating different risk levels: Conservative investors hesitate to invest in equity, while aggressive investors may not find much scope for returns in debt. Novice investors may not consider other asset classes. By combining asset classes in different proportions, multi asset allocation funds can cater to investors across a wide spectrum of risk appetites, especially in the long run. A conservative investor can be more open to including equity in their portfolio if their investment horizon is long. They can also opt for funds like multi asset funds that have a debt component along with an asset class like commodity. Someone who is comfortable with risk may still find enough high-risk options within multi-asset allocation funds with a high return potential, while also getting the advantage of debt and other instruments in certain market conditions.

Key factors to keep in mind before investing

Investment goals: Define what you hope to achieve, whether it's long-term growth potential or relative capital stability. Aggressive investors who are seeking high reward potential and are comfortable with significant risk may prefer funds with small or mid cap stocks over the balanced approach of multi-asset allocation funds.

Risk tolerance: Assess your risk-appetite. The asset allocation pattern of multi-asset funds can vary from scheme to another. The higher the equity allocation, the greater the risk.

Asset allocation: Review how the fund spreads investments across different assets. This diversification is key to managing risk and should align with your personal investment goals and risk tolerance.

Fund manager's expertise: Check the experience and past performance of the manager handling the fund. An experienced manager with a proven strategy for different market conditions can add significant value.

Liquidity needs: Consider how easily you can withdraw your money if needed. Some multi-asset funds offer more liquidity than others, which is important if you think you may need access to your funds at short notice.

Multi asset allocation fund investment strategies

According to the Securities and Exchange Board of India, a multi asset allocation fund needs to invest in at least three asset classes, with an allocation of at least 10% in each asset class. The asset classes could include debt, equity, real estate, commodities, among others. Most mutual fund schemes have a typical allocation range for the asset classes, within which they can increase or decrease the weightage of each based on market movements.

Here are some of the important multi asset allocation fund strategies:

Diversification: Creating a diversified portfolio at an individual level can be difficult. A multi asset mutual fund helps investors achieve diversification within a single scheme. This is important because instead of pegging your fortunes to only one or a limited number of securities or instruments, a diversified portfolio distributes risk across multiple asset classes and instruments.

Flexibility: The room to adjust the portfolio allocation between asset classes helps such funds potentially manage market volatility better. When a particular asset is performing well in the market, the fund manager can increase the exposure to it, or can reduce the weightage of an asset class that is faring poorly at a given time.

Asset class correlation: The correlation between two asset classes is a measure of how they move with respect to each other. If two asset classes have a negative correlation, that means they move in opposite directions – one tends to go up when the other goes down. For instance, debt and equity often move in opposite directions. So, a multi asset allocation fund can rebalance a portfolio in favour of equity when stocks are doing well or can increase the weightage of debt if fixed-income instruments are providing more stable returns in a volatile environment. If both debt and equity are performing poorly, other asset classes such as gold, silver or real estate may emerge as a better bet.

Strategies of individual schemes: Multi asset allocation fund investment strategies vary across schemes based on risk profile and goals. For instance, a low-to-moderate risk multi asset allocation fund may prioritise mitigated impact on capital invested or income generation with a focus on debt over equity and other assets. Schemes with a higher risk profile may skew towards equity. Some schemes may also invest in foreign securities to benefit from international market trends or may use the derivative market for hedging or arbitrage opportunities.

Multi asset allocation fund investment tips

Here are some things to consider when choosing which fund to invest in:

Past performance: Historical trends do not guarantee future performance, but it is useful to check the historic returns of a scheme – if it has been around for some time – and its performance over different market cycles. Compare a scheme’s performance with that of its peers in the same category and against its benchmark index.

Align your risk appetite with scheme: Looking at past returns is not enough. The risk profile of a scheme needs to match your own risk tolerance level. Multi asset allocation funds can range from low to very high risk based on their asset allocation pattern. High-risk funds usually have a large equity component, which may not be suitable for conservative investors who are more comfortable with fixed-income securities.

Consider your investment horizon and goals: A high-risk investment with potential for capital appreciation may be suitable to you if your investment horizon is long – over five years or so – because markets can be quite volatile in the short term but tend to stabilise in the long run. In contrast, for a shorter investment horizon, a low-risk scheme that focuses on income generation or less volatility by investing predominantly in fixed-income funds may be more suitable.

Check the fund manager’s details: Since this is an actively managed fund with the scope for frequent portfolio modification, the fund manager’s role is key. Hence you must research the experience and past performance of the fund manager.

How to choose the right multi-asset allocation fund

These funds are suitable for investors with a moderate-to-high risk appetite. When choosing a fund, you should consider the following:

- The risk-reward ratio: The selection of the fund should depend not just on its historical performance but also its risk level, which will be displayed on its website as well as in the scheme-related documents. Choose an investment that offers good returns at a risk level that you are comfortable with.

- The fund manager: The role of a fund manager is crucial in a multi asset allocation fund. Check the past performance of the fund manager of a scheme before investing.

- Read scheme details: Check the scheme information document to see if the typical asset allocation range of the fund aligns with your financial goals. For example, if you’re not comfortable with too much equity in your portfolio, a particular fund may not be right for you.

- Consider your investment horizon: Multi asset allocation funds are usually recommended for a medium-to-long duration so that they can make the most of more than one market cycle. This is especially so when the equity component of a fund is high as stock market performance can be volatile in the short term.

Conclusion

Multi-asset allocation funds allow investors to diversify their portfolios without having to manage multiple investments. With professional management and built-in measures for risk mitigation, these funds can be a suitable option for both new and experienced investors.

FAQs

What are the key advantages of multi-asset allocation funds?

The key advantages include diversified investment through a single fund, professional management, and the potential for balanced risk and returns based on varying market conditions.

How do multi-asset allocation funds differ from traditional mutual funds?

Unlike traditional mutual funds that typically focus on one type of asset or at most two asset classes, multi-asset allocation funds invest in a variety of asset classes, offering broader diversification and potentially reduced risk.

Can investors customise their asset allocation in multi-asset allocation funds?

The asset allocation pattern is managed by the fund managers based on the fund's strategy. However, some funds may offer variants that cater to different risk tolerances and investment preferences. Investors must check the asset allocation before investing.

Are there any drawbacks or risks associated with investing in multi-asset allocation funds?

While multi-asset allocation funds mitigate some risks through diversification, they are still subject to market risks, and the returns can vary.

What role does market analysis play in managing multi-asset allocation funds?

Market analysis is key to managing multi-asset allocation funds as it helps fund managers make informed decisions about where and how to allocate resources with an aim to maximise returns over the long term and minimise risks.

What is the difference between multi asset allocation funds and other mutual fund schemes?

Multi asset allocation funds invest at least three asset classes, such as equity, debt and commodities. Traditional mutual funds schemes either invest primarily in one asset class – debt or equity – or could have a hybrid allocation between debt and equity.

How do multi asset allocation funds manage risk?

Such funds manage risk through diversification across at least three asset classes and by actively changing the asset allocation in the portfolio in response to market trends and fluctuations. The fund manager regularly reviews and rebalances the portfolio. The fund manager can increase the weightage of equity in the portfolio if the stock market is on the rise or can shift the focus to debt during volatile times. When both debt and equity are underperforming in the domestic market, other asset classes, such as gold, derivatives and the like.

How often should I review my multi asset allocation fund portfolio?

There is no universal rule on how often you should review your investment portfolio. Usually, it is recommended that you do so once every six months, but you can also choose a quarterly or annual review. Anything above or below that range may not be beneficial. Additionally, the fund manager for a multi asset allocation fund will undertake regular reviews of your portfolio.

What is the asset allocation strategy of multi asset allocation funds?

Such funds aim to build wealth over time while reducing risk. This is done by portfolio diversification and by altering the exposure of different asset classes in the portfolio based on market trends.

Can I invest in multi asset allocation funds via lumpsum?

Yes, you can make a lumpsum investment in multi asset allocation funds. Using a lumpsum calculator can help you estimate your potential returns over time, making it easier to plan your investment based on your financial goals.

How do multi-asset allocation funds work?

Multi-asset allocation funds invest in various asset classes like equities, debt, and commodities. A mutual fund SIP calculator can assist in projecting returns from such diversified investments.

How can I invest more efficiently in multi asset allocation funds over time?

A step up SIP strategy allows you to gradually increase your investment as your income grows. You can use a step up SIP calculator to estimate how this approach can potentially enhance your long-term wealth creation when investing in multi asset allocation funds.

Related Searches:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.