How can large and mid cap funds help in navigating market volatility?

Market volatility is hard to predict and can make investors nervous. In fact, many individuals stay away from investing in the market due to the fear of volatility. However, there are investment avenues that are tailored to strike a balance between the return potential and associated risks. For example, large and mid cap funds are designed to replicate the relatively stability of large-cap stocks along with the growth potential of mid cap stocks. Let’s check out how large and mid cap funds can help investors in navigating market volatility.

- Table of contents

- What are large and mid cap funds?

- How do they help during market volatility?

- Impact of market volatility on large and mid cap funds

What are large and mid cap funds?

Large and mid cap funds are a unique category of mutual funds that invest in a blend of both large-cap and mid cap stocks. This diversification allows investors to benefit from the relative stability of large-cap stocks and the growth potential of mid cap stocks. The dual nature of these funds positions them strategically to counter the ups and downs of the market.

Moreover, these funds invest in companies with varying market capitalisations:

The large cap allocation is done in the top 100 companies by market cap. These companies boast strong financials, stable earnings, and a proven track record in weathering market storms.

The mid cap allocation targets companies ranked 101 to 250 by market cap. These stocks offer growth potential, as they are well-established but have room for significant future expansion.

Investing in large and mid cap funds offers the dual advantage of relative stability and growth potential. These funds aim to combine the consistency of large-cap stocks with the growth potential of mid caps in a single investment instrument.

How do they help during market volatility?

Here's how large and mid cap funds lend relative stability to the portfolio during volatile times:

Diversification: Large and mid cap funds invest in a basket of companies, spreading your risk across sectors and industries. This means a downturn in one sector doesn't necessarily erode your entire portfolio.

Relative stability: Large-cap companies, due to their size and established businesses, tend to be less susceptible to short-term market fluctuations. Their inclusion in these funds seeks to provide cushion for the overall portfolio during volatile periods.

Growth potential: Market volatility may lead to short-term fluctuations, but large and mid cap funds are structured with a long-term perspective. While large-cap stocks offer relative stability, mid cap stocks add a dash of growth potential. Their smaller size allows them to be more agile and adapt to changing market dynamics, potentially delivering reasonable returns over the long term.

Professional management: Fund managers of large and mid cap funds often employ active management strategies. This means they actively monitor market conditions and adjust the fund's portfolio accordingly. During volatile times, the flexibility of active management allows fund managers to make timely decisions, potentially minimising losses and optimising the return potential.

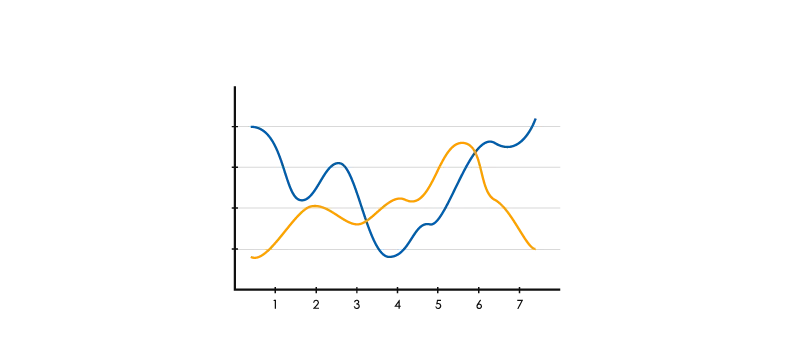

Impact of market volatility on large and mid cap funds

It's important to remember that no investment is immune to volatility. Thus, large and mid cap funds are susceptible to significant price fluctuations in the short to medium term. Market volatility also underscores the need for investors in large and mid cap funds to adopt a long-term approach and remain vigilant during turbulent market conditions. Additionally, portfolio adjustments by fund managers and changes in investor sentiment can also impact the fund’s performance.

For example, during volatile periods, investors may redeem their investments, further affecting liquidity and returns. However, large and mid cap fund managers have the flexibility to diversify and rebalance portfolios, as well as implement hedging strategies to counter volatility. This emphasises the importance of active management in a large and mid cap fund. Diversification across asset classes and investment styles can also help mitigate the risks associated with market fluctuations.

Conclusion

While market volatility can be tough to handle, large and mid cap funds can be your compass, guiding you towards your investment goals. Understanding their strengths and limitations, and staying invested for the long term, can help you in navigating market volatility with large and mid cap funds. However, investors should assess their risk tolerance and investment objectives carefully when considering large and mid cap funds, especially during periods of heightened market volatility.

FAQs:

How do large and mid cap funds differ from other mutual funds?

A: Unlike funds focused solely on large-cap, mid cap, or small-cap stocks, large and mid cap funds offer a diversified approach. They aim to capture growth opportunities from mid cap stocks while seeking to benefit from the relative stability of large-cap stocks.

Should I stop investing during market volatility?

A: Panicking and selling out during a downturn can be detrimental to long-term returns. Market volatility is a normal part of the investment cycle. Staying invested allows you to ride out the waves and benefit from the potential recovery. A consistent investment strategy like SIP (Systematic Investment Plan) can help you stay disciplined and avoid emotional decisions during volatile periods.

How can I further mitigate risks during market volatility?

A: Diversification is key. Don't put all your eggs in one basket. Invest across different asset classes like equity, debt, and gold to spread your risk. Additionally, maintaining a long-term investment horizon helps you weather short-term market fluctuations and focus on the bigger picture.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.