How investment horizons impact arbitrage funds

Arbitrage funds are hybrid mutual funds that aim to capitalise on the price difference of the same asset between two or more markets. These funds can be a suitable option for investors seeking to mitigate market volatility and risk while potentially generating returns in the long run. However, investment horizon is a key factor in the effectiveness of arbitrage funds. In this article, we will explore this impact of investment horizon on arbitrage fund effectiveness and how to choose the right time span for you.

- Table of contents

- How arbitrage funds mitigate volatility

- Impact of investment horizons on arbitrage funds

- Factors to consider when choosing an investment horizon for arbitrage funds

- Bajaj Finserv Arbitrage Fund

How arbitrage funds mitigate volatility

Arbitrage is the simultaneous buying and selling of an asset, equity instrument or commodity in two market segments to benefit from the price difference between them. The investor will purchase the asset at a lower rate from one market and immediately sell it at a higher rate in the other. Such a trade can happen in an asset that is trading at different rates in two different exchanges, or between the spot and derivatives markets.

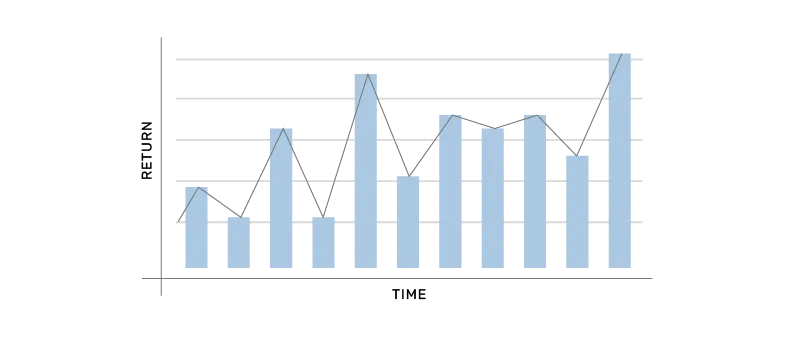

Arbitrage mutual funds provide the opportunity for potentially reasonable, relatively low risk returns that are largely uncorrelated with broader market conditions because the buying and selling happen simultaneously, before market volatility can come in. Thus, arbitrage funds tend to provide returns that demonstrate a low correlation to traditional asset classes like stocks and bonds. This helps reduce the overall portfolio volatility.

Impact of investment horizons on arbitrage funds

The investment horizon is the time span for which an investor plans to hold a security or investment.

The right time horizon for an investor would depend on how they intend to use the funds. Arbitrage funds tend to perform well in times of volatility or when the difference between prices in cash and futures market is large. They yield lower returns when the gap between the two markets is small. So, investors can tactically invest in arbitrage funds when the spread between cash and futures is high.

Alternatively, arbitrage funds can also be suitable for risk-averse investors who want to benefit from the growth opportunities offered by the equity market but do not want the accompanying risks and do not want to time the market. In this case, an investment horizon of six months or more could be useful because adequate arbitrage opportunities may not exist in the market in the very short term.

However, for long term investments of three or five years, an arbitrage fund may yield significantly lower returns than other types of equity funds.

An investment horizon of more than a year can also benefit investors from a taxation perspective. As arbitrage funds invest largely in the equity market, they are taxed the same way as equity funds. The long-term capital gains tax (for holdings of more than a year) on equity funds is 10%, as opposed to 15% on short-term capital gains.

An investment horizon of more than a year can also benefit investors from a taxation perspective. As arbitrage funds invest largely in the equity market, they are taxed the same way as equity funds. For equity-oriented arbitrage funds, gains on units redeemed within 12 months are considered short-term capital gains and taxed at 20%, while gains on units held for more than 12 months qualify as long-term capital gains. Long-term gains up to ₹1.25 lakh in a financial year are exempt from tax, and any amount above this is taxed at 12.5%.

Factors to consider when choosing an investment horizon for arbitrage funds

Apart from understanding the impact of investment horizon on arbitrage fund, there are several factors to consider when choosing the same:

Market conditions: The current market conditions should also be considered when choosing an investment horizon. For example, if the market is experiencing high volatility, a shorter investment horizon may be appropriate to potentially take advantage of short-term arbitrage opportunities.

Risk tolerance: The risk tolerance of the investor should also be considered when choosing an investment horizon. A longer investment horizon allows for more time to ride out market fluctuations.

Liquidity and transaction costs: The investment horizon can influence liquidity and transaction costs on arbitrage returns. Shorter investment horizons may need more frequent trading to capture arbitrage opportunities, which can increase transaction costs and reduce net returns. Longer investment horizons may allow for more strategic trading decisions and better timing of transactions to minimise costs

Bajaj Finserv Arbitrage Fund

Bajaj Finserv Asset Management Limited offers the Bajaj Finserv Arbitrage Fund, an open-ended scheme strategically investing in arbitrage opportunities. The scheme aims to generate potential returns by capitalising on arbitrage opportunities in the cash and derivatives segments of equity markets, with a balanced investment approach in debt and money market instruments. The scheme is tailored for investors eyeing short-term income potential from arbitrage opportunities. However, it is crucial for investors to consult financial advisors before making decisions.

Conclusion

We just saw how different investment horizon impact arbitrage fund effectiveness. The choice of investment horizon will depend on various factors, including the investment objectives, market conditions, risk tolerance, and fees and charges. By understanding the impact of different investment horizons on arbitrage funds, investors can make informed decisions and choose the most appropriate investment horizon for their needs.

FAQs

Can the investment horizon affect the returns of arbitrage funds?

Yes, the investment horizon can affect the returns of arbitrage funds. A shorter investment horizon may be more appropriate for funds that focus on short-term market inefficiencies, while a longer investment horizon may be more appropriate for funds that focus on long-term market trends.

Are there any specific market conditions that favour short-term investment horizons for arbitrage funds?

Yes, there are specific market conditions that favour short-term investment horizons for arbitrage funds. For example, during periods of high market volatility, short-term arbitrage opportunities may be more abundant, making a short-term investment horizon more appropriate. Additionally, in markets with frequent price fluctuations, a short-term investment horizon can allow the fund to take advantage of transient price differences.

How does the investment horizon impact arbitrage fund returns?

A longer horizon helps potentially smooth out short-term fluctuations in arbitrage opportunities, while a shorter horizon may show more variation. Returns are market-linked and not assured.

What is the best investment horizon for arbitrage funds?

A short or medium-term investment horizon of a few months to a year or more may be suitable for arbitrage funds. Over longer horizons, they may not offer the potential to yield returns that can outpace inflation as they are low risk and low return avenues.

Can market volatility affect the investment horizon for arbitrage funds?

Yes, market volatility can influence the suitable investment horizon for arbitrage funds. Higher volatility often widens arbitrage spreads, improving potential returns, while stable markets may reduce opportunities. A longer horizon (six months or more) can help smooth out fluctuations, while staying invested for over a year also provides tax benefits on capital gains.

Related Searches:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.