Nimesh Chandan has over 24 years of experience in the Indian Capital Markets. He has spent 18 years in Fund Management- managing and advising domestic and international investors, retail as well as institutional. Prior to joining Bajaj Finserv Asset Management Ltd., he has worked with Canara Robeco Asset Management as Head of Investments, Equities (Domestic and Offshore). He has also worked with other asset management companies including Birla Sunlife Asset Management, SBI Asset Management and ICICI Prudential Asset Management.

{

"debt": "Debt/Cash 100%",

"equity": "Equity 0%",

"ONRGG": {

"nav": "10000",

"date": "28-02-2025",

"since": {

"bajajflexi": "6.68",

"bajajsmall": "6.76",

"bajajnifty": "7.22"

},

"6_month_ago": {

"bajajflexi": "6.61",

"bajajsmall": "6.68",

"bajajnifty": "7.50"

}

},

"ONDGG": {

"nav": "10001",

"date": "28-02-2025",

"since": {

"bajajflexi": "6.73",

"bajajsmall": "6.76",

"bajajnifty": "7.22"

},

"6_month_ago": {

"bajajflexi": "6.66",

"bajajsmall": "6.68",

"bajajnifty": "7.50"

}

}

}

Bajaj Finserv Overnight Fund

| NAV | Risk Type |

|---|---|

|

|

Low

|

Total AUM

₹445.56 crores

as on 28-02-2025

Benchmark

CRISIL Liquid Overnight Index

Min. SIP Amount

₹1000

Inception Date

05-07-2023

Benefits

Relatively stable returns

Overnight funds offer relatively stable returns to investors that may be marginally higher than the returns provided by a savings account.

Insta redemption

Bajaj Finserv Overnight Fund offers insta redemption, where up to Rs.50,000 or 90% of your balance, whichever is lesser, can be redeemed instantly.

Suitability for short-term goals

Overnight funds may be suitable for short-term financial goals like parking surplus funds or meeting short-term financial obligations.

Investment Objective

The scheme aims to provide reasonable returns commensurate with low risk and high level of liquidity through investments made primarily in overnight securities having maturity of 1 business day.

However, there is no assurance that the investment objective of the Scheme will be achieved.

Asset Allocation Pattern

Risk profile - Low to moderate

Portfolio - Current Allocation

Historical Returns (as per SEBI format) As on 28-02-2025

| Tenors | CAGR | Current value of ₹10,000 Invested | ||

|---|---|---|---|---|

| Since Inception | 1Y | Since Inception | 1Y | |

| Bajaj Finserv Overnight Fund | 6.68% | 6.61% | 11,129 | 10,661 |

| CRISIL Liquid Overnight Index | 6.76% | 6.68% | 11,143 | 10,668 |

| CRISIL 1 Year T-Bill Index | 7.22% | 7.50% | 11,222 | 10,750 |

Disclaimer: Past performance may or may not be sustained in future.

Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Performance is provided for Regular Plan - Growth Option. Inception Date: 5th July 2023 Period for which scheme's performance has been provided is computed basis last day of the previous month preceding the date of this material.

Returns less than 1 year period are simple annualized and greater than 1 year are compounded annualized.

Portfolio Parameters As on 31-01-2025

| YTM

|

6.34% |

| Average Maturity

|

3 Day |

| Macaulay Duration

|

3 Day |

| Modified Duration

|

3 Day |

YTM details should not be construed as indicative returns and the securities bought by the Fund may or may not be held till the respective maturities.

Who Should Invest?

- Institutions that want to park surplus funds overnight

- Investors with idle cash looking to generate returns over and above current account

Fund Managers

Fund Details

Type of Scheme

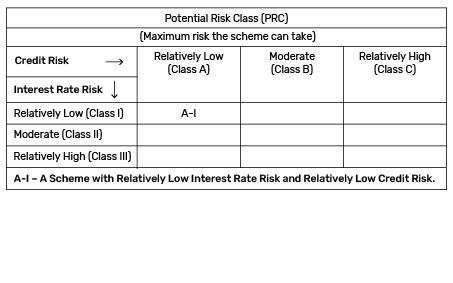

An open ended debt scheme investing in overnight securities with relatively low interest rate risk and relatively low credit risk.

Minimum Application Amount

- Fresh Purchase (Incl. Switch-in): Minimum of Rs. 100/- and in multiples of Re. 1/- thereafter.

Load Structure/Lock-In Period

Entry load - Not applicable

Exit load - Nil

Potential Risk Class (PRC)

- The PRC matrix identifies the highest amount of potential risk that a debt mutual fund can assume.

- This regulation was implemented by SEBI on December 1, 2021, making it essential for fund houses to categorize all new and existing schemes under a potential risk class (PRC) matrix.

Product Label and Riskometer

This product is suitable for investors who are seeking*:

- Regular income over short term that may be in line with the overnight call rates.

- Investment in money market and debt instruments with overnight maturity.

Bajaj Finserv Overnight Fund Overview

Bajaj Finserv Overnight Fund is an open-ended scheme investing in debt, money market instruments and cash and cash equivalents with a maturity of one day. The very short maturity of the underlying securities can mitigate the interest and credit rate risk of the fund while providing high liquidity.

Bajaj Finserv Overnight Fund can be a suitable option for investors seeking regular income over the short term that may be in line with the overnight call rates. It can also suit investors with idle cash who want an avenue that can potentially offer better returns than a current account, or corporates who want to park surplus funds overnight. Investors looking for a short-term and liquid investment avenue with the potential to offer reasonable returns at relatively low risk can consider investing in Bajaj Finserv Overnight Fund.

Investments for Bajaj Finserv Overnight Fund start at Rs. 100.

Frequently Asked Questions

Bajaj Finserv Overnight Fund aims to generate income by investing in debt, money market instruments, and cash and cash equivalent with overnight maturity. Since the securities in these funds mature the next day, these funds are not exposed to the kind of interest rate risk or default risk like the rest of the debt funds. Investing in Bajaj Finserv Overnight Fund can help meet the needs of the investors who want to deploy their funds for a very short period.

Easy access to funds, suitability for short-term goals, relatively stable returns, high liquidity, and comparatively low risk are some of the benefits of investing in Bajaj Finserv Overnight Fund.

Bajaj Finserv Overnight Fund can be a suitable option for investors who are seeking regular income over short term that may be in line with the overnight call rates. Also, investors who are looking to invest in money market and debt instruments with overnight maturity can consider investing in this scheme. Investors should consult their financial advisor in case of any queries.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.