Our Investment Philosophy reflects what we, as an organisation, believe will generate a good return on equity investment for our investors in the long term. It dictates our goals and guides decision making.

Alpha (a) is a term used in investing to describe an investment strategy's ability to beat the market.

Alpha is thus also often referred to as excess return or the abnormal rate of return in relation to a benchmark, when adjusted for risk. Essentially, it means doing better than the crowd without taking disproportionate risk.

Information Edge

Collecting superior information

Analysts and portfolio managers strive to collect superior information about the business and the management of the company. They try to generate superior earnings forecast and the balance strength of the company and the industry, thereby trying to 'beat the market' on information edge. This is an important source of alpha for an investor. However, over the years, retaining the information edge has become more difficult and expensive. With a whole lot of investors trying to collect superior information, how can an investor be sure to continuously have accurate and material information about the companies, ahead of others, all the time?

Quantitative Edge

Processing information better

Even if you don't have material information earlier than the crowd, you can still generate better outcomes if you are able to process this information better. Investors develop models and algorithms with enhanced predictive powers to forecast the next move. Fund managers who invest based on some pure formal analytical models are quantitative managers. Here, the goal is to try and beat other investors based on the sophistication of procedures or analytics. The analytical edge can be quite useful until it gets copied by many, and then it may stop generating superior returns

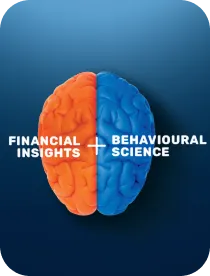

Behavioural Edge

Exploiting behavioural biases

As the name suggests, this edge is achieved by superior behaviour in reacting to the inputs available to maximise alpha. Modern finance assumes people behave with extreme rationality. However, researchers in behavioural finance have shown that this is not true. Moreover, these deviations from rationality are often systematic. Behavioural managers try to exploit situations where securities are mispriced by the market because of behavioural factors. At Bajaj Finserv AMC, we endeavour to combine the best of these edges